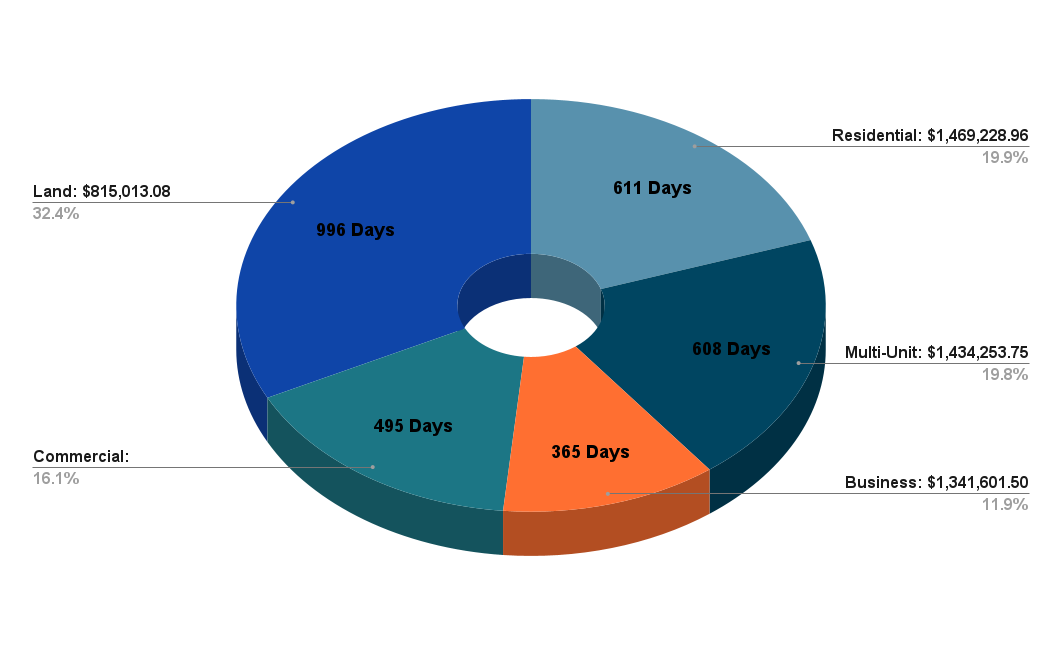

Continuing its legacy of providing insightful market updates, the Cayman Islands Real Estate Brokers Association (CIREBA) is delighted to release the 2018 Property Market Review. This comprehensive report captures the pulse of the real estate scenario, spotlighting key shifts, opportunities, and trends within the Cayman Islands. 1. Comparative Analysis with 2017: 2. Listing Duration Insights: Land properties in 2018 saw a longer duration on the market compared to 2017, suggesting potential fluctuations in demand or supply over the year. Commercial properties, however, reduced their market time, indicating a surge in demand. 3. Pricing Variations: Notably, there were pricing variations across all segments. For instance, the land saw a price elevation from approximately $600k in 2017 to $815k in 2018. The Cayman Islands' property market showcased resilience and growth throughout 2018. With a more diverse range of properties entering the market and the noticeable progression in sales, the future appears promising. CIREBA remains committed to facilitating seamless transactions, ensuring that both buyers and sellers receive maximum value. As we anticipate the prospects of 2019, the foundation laid in 2018 offers much optimism.Key Figures

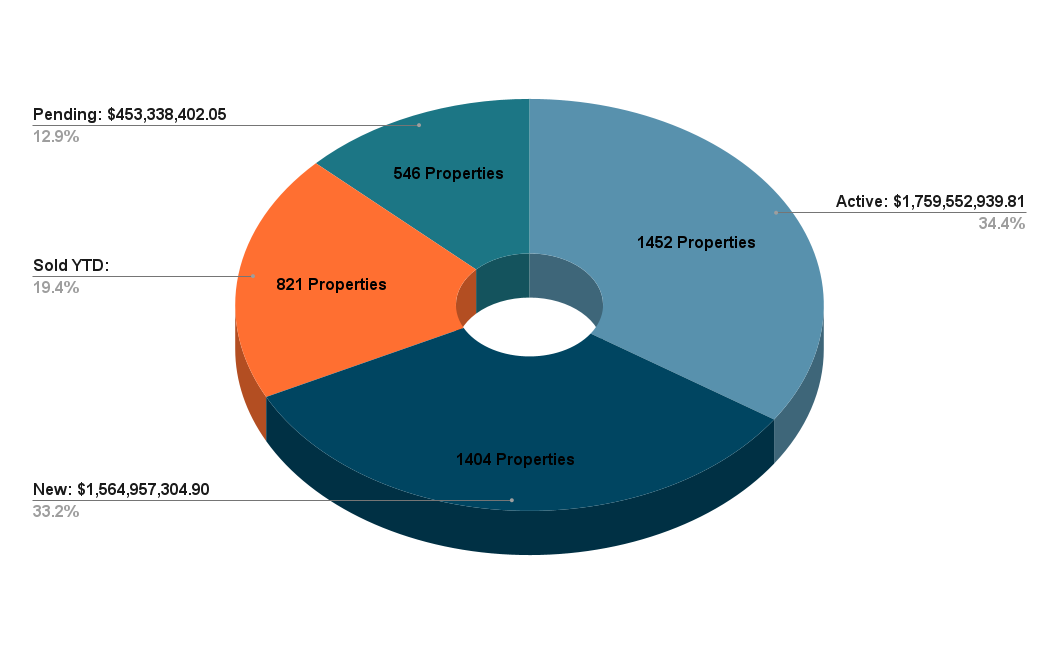

Number of Properties 2018:

Active Listings Average Time on Market 2018:

Observations and Comparisons: